Swipe For More >

Sorghum Win out West: CARB Fix on the Horizon

Learn how NSP led an exhaustive effort to supply better nitrogen fertilizer data for the California Air Resources Board calculations and how the newest draft versions showed sorghums carbon intensity scores improving.

Sorghum farmers are on the brink of a $31 million victory in a key environmental market. When the readopted California Low Carbon Fuel Standard (LCFS) takes effect in January 2019, sorghum ethanol will have a carbon intensity (CI) score similar to that of corn ethanol. Competitive CI scores are essential as they directly impact an ethanol producers’ ability to bid for grain. NSP worked with the California Air Resources Board (CARB), the Argonne National Laboratory, Conestoga Energy Partners, White Energy, Western Plains Energy and a number of other stakeholders for the last four years to level the CI playing field for sorghum farmers.

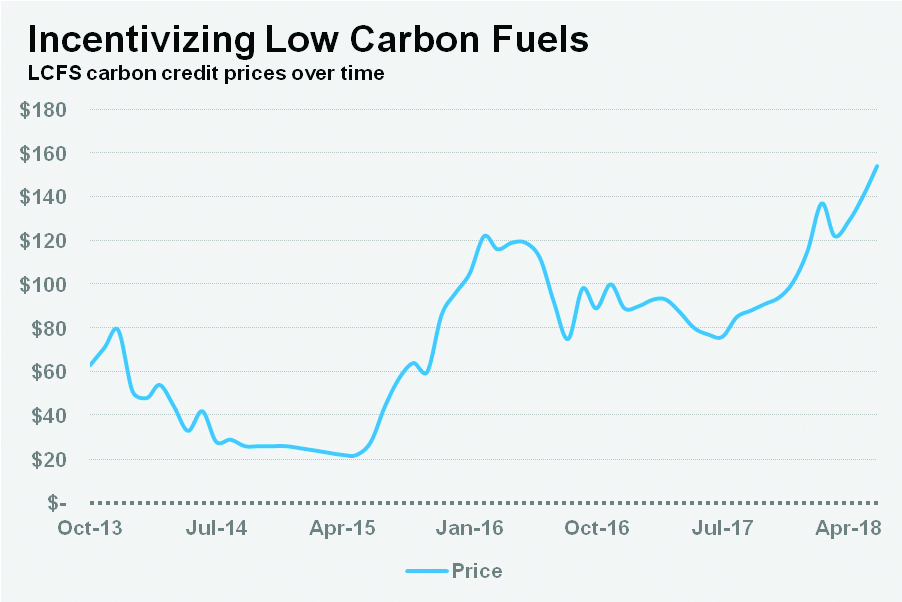

Aimed at reducing the CI of fuels used in California by 10 percent between 2011 and 2020, the LCFS incentivizes low CI fuel using a system wherein fuels with low CI scores generate carbon credits. The lower the CI, the more credits the fuel generates. Historically, sorghum ethanol had a small CI advantage relative to corn ethanol under the LCFS, and this advantage translated into a couple cents per bushel. However, in mid-2015, CARB made changes to its CI calculations, and the advantage was turned into a disadvantage. Soon, ethanol producers had difficulty bidding for sorghum as this disadvantage coupled with soaring prices for carbon credits translated to a $0.51-per bushel penalty for using sorghum.

The problem was a shift to a greater reliance on USDA Agricultural Resource Management Survey (ARMS) nitrogen fertilizer data. Due to significant budget constraints, ARMS is not conducted as often in smaller crops such as sorghum. Accordingly, sorghum data was collected in four years out of 27 as compared to corn data that was collected in 18 out of 27 years. Three of these four sorghum years saw drought conditions in the Sorghum Belt, and this greatly reduced yields and overstated nitrogen fertilizer application. Given nitrogen fertilizer application comprises over three-fourths of the portion of CI attributable to farming activities, this shift to ARMS data significantly lowered the value of sorghum ethanol sold in California and thus the amount ethanol producers were willing to bid for the grain.

With carbon credit prices projected to continue rising (today the average credit price is over $180 as compared to the average price of $20 in the early days of the LCFS when sorghum ethanol’s advantage amounted to a couple cents per bushel), NSP led an exhaustive effort to supply better nitrogen fertilizer data for CARB’s calculations. In February, these efforts were rewarded when a draft version of CARB’s newest calculations showed sorghum ethanol’s CI score improving enough to wipe out the vast majority of the penalty. When these calculations become part of the readopted LCFS when it takes effect in January 2019, sorghum ethanol sold in California should be much closer to its historical value and sorghum will be back on a more level playing field with corn ethanol.

At a time when trade negotiations are causing historic levels of uncertainty-driven price decline, this CI change is a substantial win for farmers and ethanol producers looking to add value to sorghum.