Swipe For More >

Mergers & Acquisitions Impacting Sorghum

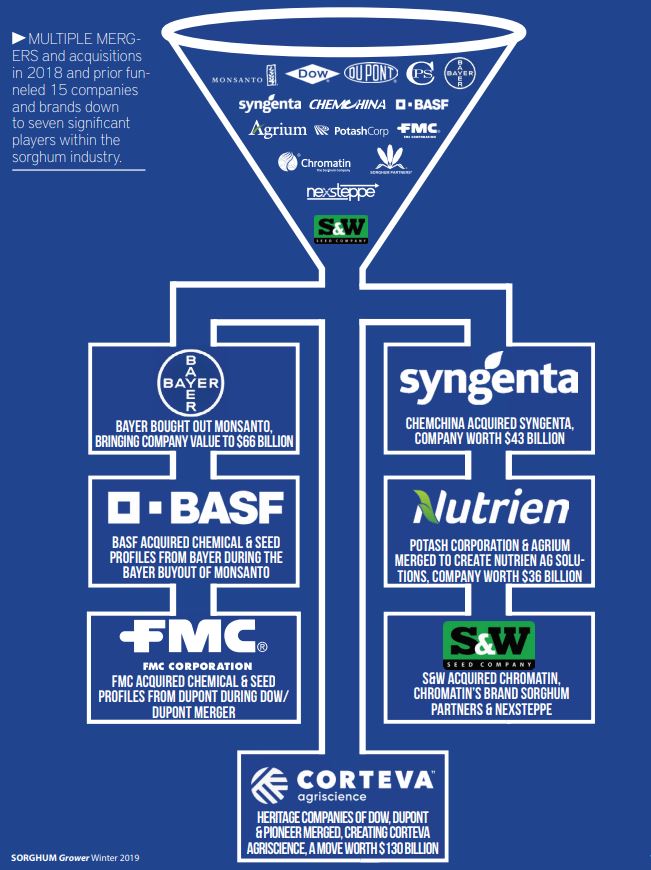

Sorghum seed and chemical assets are on the move. Look into the most recent and relevant changes happening within the sorghum industry by the way of industry mergers and acquisitions.

In the past 30 years, the businesses involved in providing seed and crop protection products to American farmers have undergone significant structural changes. Many of these changes were driven by the traditional economic factors in business whereby companies consolidate, merge, acquire and out-compete each other for market share and technology.

The boom in farm input bundling, traited seeds and broad spectrum pesticides have brought us into modern agriculture where change is happening in a constant state of chaos. For sorghum and sorghum-related inputs, these changes have been front and center.

While U.S. seed and crop protection products were historically dominated by the Big 6, which, depending on who you talk to, is now approximately the Big 3.7125, Sorghum seed and seed production have always had a mix of players ranging from multinational conglomerates to smaller traditional companies.

DuPont’s flagship brand of sorghum seed, Pioneer, now under Dow-DuPont’s Corteva, has in recent years been a globally recognized brand in sorghum seed. When Dow Chemical and DuPont merged in 2017, what really changed was that sorghum seed was now under not one but two companies that have always had a major role in crop protection, providing many pesticide products used in sorghum and row crop agriculture. Now with Dow and DuPont together, there should be a greater focus on developing advanced sorghum seed simultaneously with new and existing crop protection products.

It makes sense to bring seed and chemicals to the market simultaneously. While a very challenging concept, it will be something new for sorghum, and hopefully famers will see the benefits in the field.

One of the ripple effects of the Dow DuPont merger was a divesting of some assets to FMC, a player in the crop protection space for sorghum.

When Bayer acquired Monsanto in 2018, another flagship sorghum seed brand, Dekalb, was shuffled amongst global giants. However, prior to this acquisition, the sorghum seed division of Monsanto was sold to Remington Seeds in a joint venture named Innovative Seed Solutions. Innovative Seed Solutions continues to develop sorghum germplasm sold under the Dekalb brand along with a host of other labels. As a result of the joint venture, Bayer should have some influence on sorghum seed development. Considering Bayer’s existing technology platforms combined with their purchase of new and existing offerings from Monsanto, the merger should bode well for sorghum seed advances.

Syngenta was sold to ChemChina in 2016. From a sorghum seed standpoint, the sale changed very little as the company did not have large market sorghum germplasm assets. However, Syngenta has typically been a major player in the crop protection space, with products used in sorghum.

BASF, the world’s largest chemical company, has also undergone changes. With the steady flow of mergers and acquisitions, BASF purchased some seed assets from Bayer. While these assets were not directly related to sorghum, they did turn BASF into a seed company—not just a chemical company.

As previously mentioned, sorghum seed has always had additional players in the sorghum genetics market. At one point, these mom and pop seed companies held significant domestic and global market share in the sorghum seed business. Decades ago, companies such as Crosbyton Seed, Garrison/Townsend, NC+, Production Plus and others were ground-up seed companies that have since been rolled into one of the remaining seed market players. Garrison and Crosbyton were acquired by Advanta, which is owned by UPL, and this acquisition laid the foundation for Advanta to enter the market under their flagship brand, Alta Seeds.

S&W Seed is the newest player in the sorghum seed market. During the past two years, they acquired sorghum seed businesses from two venture capital-backed sorghum companies—Chromatin and their flagship brand Sorghum Partners. S&W also purchased NexSteppe’s germplasm. NexSteppe was dedicated to developing seed for biomass and sweet sorghum production. Chromatin and NexSteppe were unique examples of seed technology providers in sorghum in that they were either completely or mostly focused on sorghum—a rarity in the modern seed industry.

Richardson Seeds stands as one of the longest family-run sorghum seed companies in the U.S. NuSeed, a division of NuFarm, acquired Richardson Seeds and their aligned company, MMR, in 2011; however, the company still operates in both domestic and global markets as it has for many years.

Finally, there is a long list of other seed companies and providers that play a key role in branded and private label markets. Examples include Warner Seed, Scott Seed, AgReliant Genetics, Coffey Seed, Land O’Lakes and Nutrien (formerly branded as CPS). While these companies are also subject to mergers, their impacts may not be as obvious across the sorghum seed market or the sorghum crop protection space. Many of these smaller companies provide valuable assets to farmers large multinational companies cannot, namely developing products that target small, regional or specialty areas for sorghum production.

What does all of this recent and past change mean? The short answer is we are not sure. Despite ongoing business deals, the brands of sorghum seed being sold in the U.S. are still provided by one of a handful of private sector breeding programs dominated by one or two of the major global brands such as Pioneer and Dekalb along with their in-house counterparts. S&W Seed’s recent acquisitions position them well for new technology releases with the rest of the market comprised of the remaining players and any companies that are licensing partial or full genetics.

With the decade-long lags in the development of new modes of action on the chemical front and many off-patent products available combined with sorghum’s small global acreage footprint, sorghum still only has a few chemical options for most pest control scenarios. This situation is not new, but the consolidations have raised concerns about future product offerings.

The National Sorghum Producers has also felt the physical and financial effects of these consolidations over the past few years. As companies and brands have been absorbed by this latest round of agriculture integration, NSP is now faced with fewer partners with which to collaborate with on important regulatory and legislative issues for sorghum.

An additional result of the various consolidations—and likely equally as challenging—is the constant turnover in company staff who oversee sorghum products. While this ping-pong effect of personnel will likely settle out in the coming years, it makes NSP and the Sorghum Checkoff’s job of educating farmers on the latest private sector advancements unorganized at best.

With sorghum seed and chemical assets on the move, maybe Albert Einstein was right saying, “Nothing happens unless something is moved.”