Emergency Relief Program

Background: What is ERP?

On May 16, USDA released details of the Emergency Relief Program (ERP) for 2020 and 2021, formerly known as WHIP+. A one-pager created by Combest, Sell & Associates explaining the program can be found here.

The funding for this program is from $10 billion within the Extending Government Funding and Delivering Emergency Act allocated for assistance to agricultural producers impacted by wildfires, droughts, hurricanes, winter storms and other eligible disasters experienced during calendar years 2020 and 2021.

For impacted producers, existing Federal Crop Insurance or Noninsured Crop Disaster Assistance Program (NAP) data is the basis for calculating initial payments. USDA estimates that phase one ERP benefits will reach more than 220,000 producers who received indemnities for losses covered by federal crop insurance and more than 4,000 producers who obtained NAP coverage for 2020 and 2021 crop losses.

ERP Phase 1 will cover losses to crops, trees, bushes, and vines due to a qualifying natural disaster event in calendar years 2020 and 2021. A crop insurance indemnity or NAP payment must have been received to qualify for Phase 1.* Eligible crops include all crops for which crop insurance or NAP coverage was available, except for crops intended for grazing (grazing losses are covered under a separate program). Qualifying natural disaster events include wildfires, hurricanes, floods, derechos, excessive heat, winter storms, freeze (including a polar vortex), smoke exposure, excessive moisture, qualifying drought and related conditions.

*Note: If a crop insurance indemnity or NAP payment was not received by the producer, losses under this program will be paid under Phase II which has not yet been announced.

Have questions about the Emergency Relief Program?

National Sorghum Producers is conducting a survey to help answer questions from our producers about the Emergency Relief Program. Click on the link below to submit your response.

Application

FSA will send pre-filled application forms to producers whose crop insurance and NAP data is already on file because they received a crop insurance indemnity or NAP payment. Producers will need to return completed and signed ERP Phase 1 applications for each crop year to their local FSA county office. Producers must also have the following forms on file with FSA: Form AD-2047, Customer Data Worksheet; Form CCC-902, Farm Operating Plan for an individual or legal entity; Form CCC-901, Member Information for Legal Entities (if applicable); a highly erodible land conservation (sometimes referred to as HELC) and wetland conservation certification (Form AD-1026 Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) Certification) for the ERP producer and applicable affiliates. Most producers who have previously participated in FSA programs will likely have these required forms on file.

Payment Calculation

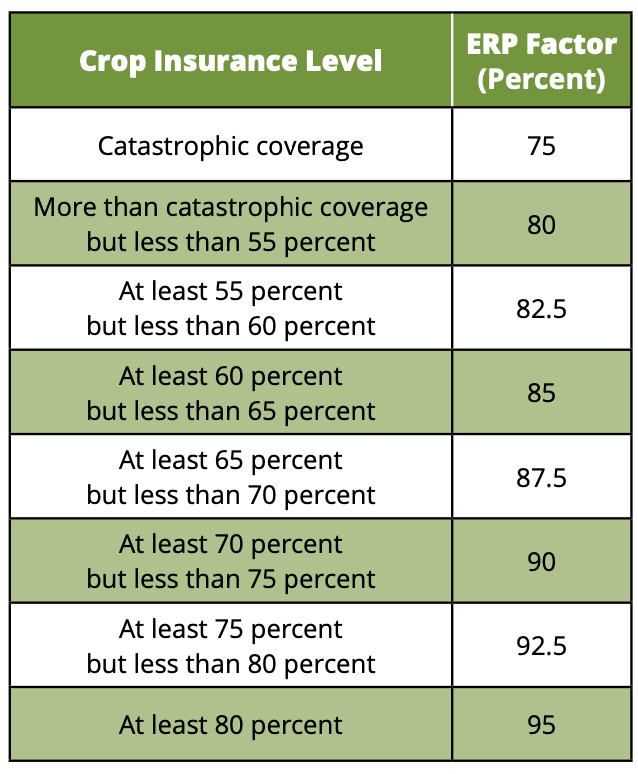

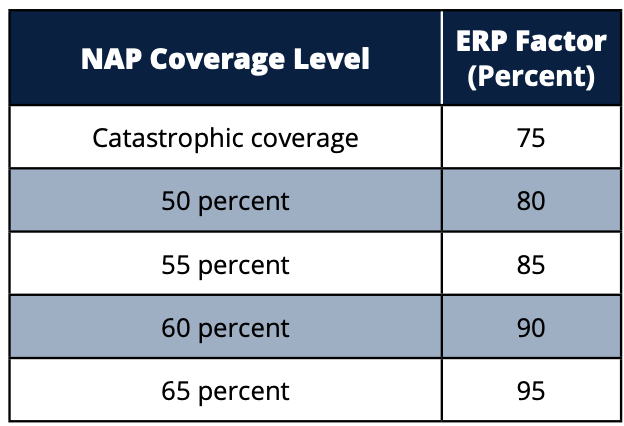

ERP Phase 1 payments will be prorated by 75 percent to ensure adequate funding for all disaster programs. The ERP Phase 1 payment calculation will depend on the type and level of crop insurance coverage obtained by the producer. The table below outlines the factors that will be used to calculate ERP. RMA and FSA will calculate each producer’s loss consistent with the loss procedures for the type of coverage purchased but using the ERP factor in place of the coverage level. The loss procedures will include the use of the Harvest Price Option (HPO). This calculated amount would then be adjusted by subtracting out the net crop insurance indemnity or NAP payment, which is equal to the producer’s gross crop insurance indemnity or NAP payment already received for those losses minus service fees and premiums paid by the producer.

Payment Limitations

If at least 75 percent of the person or legal entity’s average AGI is derived from farming, ranching or forestry related activities the payment limitation will be $250,000 per program year for most crops, with a higher rate for specialty crops. If at least 75 percent of AGI is not derived from farming the payment limitation will be $125,000 per program year for all crops. To request the increased payment limitation a producer needs to file form FSA-510 and a certification from a licensed CPA or attorney.

Future Insurance Requirement

All producers who receive a Phase 1 ERP payment are required to purchase crop insurance for the next two available years at a coverage level of 60 percent or higher. NAP crops are required to purchase at the catastrophic level or higher.

Historically Underserved Producers

Historically underserved producers, including beginning, limited resource, socially disadvantaged and veteran farmers and ranchers will receive an additional 15 percent of the calculated ERP Phase 1 payment. Producers must have a CCC-860 form on file with FSA for the applicable program year.

ERP Phase 2

Phase 2 of ERP will be announced at a later date to cover losses that were not covered under Phase 1. This will include producers who saw a shallow loss but were not able to collect an indemnity from crop insurance or NAP. It will also include producers with area based policies (SCO, STAX, ARPI, ECO, etc.) as indemnities for those policies have not yet been calculated.

Formula Explanation

Estimated ERP Payment (Box 11) = Target Revenue minus (-) calculated revenue

Target revenue is the “Expected Value of the Crop” (APH x Price Guarantee) multiplied by the relevant “ERP factor”.

Calculated revenue is the sum of “Actual Value” (realized production x price) plus any “Crop Insurance Proceeds” (MPCI, SCO, ECO, STAX, etc.) less or minus “Producer Premiums and Administration Fees”.

The “Estimated ERP Payment” in Box 11 of the FSA Form 520 is the difference between this target revenue and calculated revenue.

FAQs

Will shallow losses be included in Phase 1?

No. Phase 1 only includes producers who received an indemnity on their MPCI policy. Shallow losses were not included in the pre-filled applications sent under Phase 1. Such cases will be addressed in Phase 2.

Was the cause of loss listed on an insurance claim considered when applications were pre-filled for Phase 1?

No, the cause of loss listed on an insurance claim was not considered when applications were pre-filled for Phase 1. There is no need for insurance agents to change the cause of loss on a previous claim to align with a covered loss under ERP. Producers need to simply certify the production loss in question falls under a cause of loss listed for ERP (like excessive heat). Producers would be wise to note this covered cause of loss on their FSA-520. Please note this could also apply, for example, to hail losses that might also be attributed to “excessive moisture” and “related conditions.”

How should I fill out the share portion of the ERP application?

The share portion (column 13) of the ERP application should be filled out according to the crop insurance policy. This was included on the application to reconcile differences between RMA and FSA share reporting. This is not a place to recertify FSA shares.

Does ERP cover losses under Pasture, Rangeland, and Forage (PRF) and Annual Forage (AF)?

ERP is not designed to cover grazing losses under Pasture, Rangeland, and Forage (PRF) and Annual Forage (AF). RMA was able to delineate PRF policies, and only include qualifying policies intended for haying and exclude grazing. RMA was unable to delineate the difference on AF policies. AF policies intended for forage or hay should be submitted to FSA. AF policies intended solely for grazing were covered under Emergency Livestock Relief Program (ELRP) and should have received a Livestock Forage Disaster Program (LFP) top-up payment and should not be reported under ERP.

Please note we are seeking further clarification on this and will provide updates as soon as we receive additional information.

Is there further clarification on the portion of ERP regarding historically-underserved producers?

Socially disadvantaged, beginning and veteran farmers and ranchers qualify for a 15 percent increase in their ERP payment — but their initial payment will still be subject to the 25 percent adjustment and paid out at 75 percent of the total ERP payment. For an entity to qualify for socially disadvantaged, beginning or veteran status at least 50 percent of the interest must qualify under the intended category. Meaning a 50/50 husband and wife joint venture can qualify as socially disadvantaged if they so certify, and women qualify as a historically-underserved producer. The form can be found here.

For the entities that do not meet the requirements of a historically-underserved population, the Phase 1 ERP payment will calculate as: Phase 1 Payment = Total ERP Payment * 0.75.

For entities that do meet the requirements of a historically-underserved population, the Phase 1 ERP payment will calculate as: Phase 1 Payment = Total ERP Payment * 1.15 * 0.75.

Will I receive the full calculated amount shown in my pre-filled application in Phase 1 disbursement?

Phase 1 will be paid at 75 percent of the calculated amount on the pre-filled application. The reduction is not incorporated into the calculation (column 11) on the pre-filled applications received by producers.

I experienced a loss in that started in late 2019 and continued into 2020 causing a prevent plant claim on a 2020 crop. Am I eligible for ERP under this loss?

Phase 1 currently only includes insurance claims that have a loss date from January 1, 2020, to December 31, 2021. If the loss date falls at the end of 2019 or the beginning of 2022, then no pre-filled application will be received. FSA is currently looking into this issue regarding producers who had a cause of loss that started in late 2019 and continued into 2020 causing a prevent plant claim on a 2020 crop.

Are these any details available about Phase 2 of ERP?

Phase 2 is designed to be a catch all for any producers who were not covered in Phase 1. FSA does not currently have a date for the roll out of Phase 2. Phase 2 would cover scenarios including: shallow losses, losses on endorsements, no crop insurance purchased and other producers not included in Phase 1.

How do I certify 75 percent or more of my income comes from farming to qualify for the higher payment limit?

Entities can certify by Form 510 that 75 percent or more of their income comes from farming and receive a higher payment limit.

In order for equipment gains to be considered part of farm AGI, other net farm AGI must be greater than 66.66 percent of overall AGI. Before the Tax Cuts and Jobs Act of 2017 (TCJA) was passed, this was not much of an issue since trade-ins of farm equipment did not create any taxable gain in most cases. However, TCJA now makes all trades of farm equipment a taxable event which causes the gain to be recognized as taxable income and the equipment purchased is allowed to be fully deducted using 100 percent bonus depreciation. This causes many farmers’ tax returns to show negative Schedule F income while having overall net farm income if equipment gains were included. It appears the FSA handbook has not been updated by FSA to address this issue. Many farmers have 100 percent of their income from farming. However, they show an overall AGI loss. In this case, the farmer cannot qualify for the increased payment limit. The 2020 AGI is based on a three-year average of 2016-2018 while 2021 is based on 2017-2019. During these years, many farmers had an overall loss from farming but substantially all their income was from farming. Finally, most married farmers file joint income tax returns. Under the rules for determining AGI for the more than $900,000 AGI limits for most farm programs, CPAs and attorneys are allowed to determine what the farmer’s AGI would be if they filed a married filing separate tax return. However, they need clarity to determine if they can do the same for the more than 75 percent of Farm AGI calculations. Without this ability, many farmers will not be able to receive an increased payment due to their spouses’ income exceeding 25 percent of AGI.

I have an indemnity on a 2021 policy that had STAX, SCO, ECO, MP or ARPI. When will I receive my pre-filled application?

Producers with an indemnity on a 2021 policy that had STAX, SCO, ECO, MP, or ARPI will not receive a pre-filled application until a later date when data is available. This will not be Phase 2 but a separate mailing under Phase 1 expected late summer.

USDA officials will continue to update ERP’s frequently asked questions for both FSA and RMA which can be found on the FSA website here and the RMA website here.

I farm with my wife. Is our operation eligible for the incentive for historically underserved farmers?

Many producers filled out FSA form 520 by assigning shares of 50 percent to themselves and 50 percent to their spouse in order to take advantage of the 15 percent increase in ERP payments for historically underserved producers. However, it is important to remember that the shares assigned on form 520 must match shares reported earlier for the ARC/PLC 2022 program which began on October 1, 2021. If not, any ARC or PLC payments for 2022 will be reduced by 50 percent. For producers whose shares at FSA already represent a 50/50 split with their spouses, this reduction would not apply as form 520 filled out to reflect such a split would match the shares reported for ARC/PLC 2022. Shares for all FSA programs can be restructured going forward to reflect a 50/50 split for spouses. It should also be noted that there will be additional implications from a restructure, including conservation compliance requirements, so discuss the change with your county FSA office and crop insurance agent before making final decisions.